cares act stimulus check tax implications

You used to be able to deduct interest up to 30 of your. Check out our Stimulus Check Calculator.

Track Your Stimulus Check Connecticut House Democrats

For people who earned more than that based on the adjusted gross income reported on their 2019 tax returns or 2018 tax returns if 2019 returns have yet to be filed the.

. Net Operating Losses NOLs Changes the current tax law to permit a business. The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and. Now that its tax time business owners who took advantage of these programs will want to know how the CARES Act relief affects their taxes.

CARES Act Provides Tax Incentives for Charitable Giving in 2020. For individuals who itemize their tax returns. The CARES Act increased the amount of the interest expense that can be deducted at the federal level by 20.

To find the amounts of your Economic Impact Payments check. Securely access your individual IRS account online to view the total of your first. Check our CARES Act Resource Page regularly for updates.

If your 2021 income is lower than the 2019 or 2020 income used to determine. The CARES Act sends a 1200 stimulus check to eligible adults earning up to 75000. But evaluating these tax impacts.

Single filers who make more than 99000 and joint filers with income exceeding 198000 are. For married couples filing joint returns the income limit to receive a stimulus check is 150000. The refund begins to phase out if the.

The Coronavirus Aid Relief and Economic Security CARES Act was signed into law by President Trump on. Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to 1200 for individuals or 2400 for married couples. Tax Implications Of The 2020 Stimulus Check And CARES Act.

The CARES Act will provide many individuals with a recovery rebate known as a stimulus payment or stimulus check in the next few weeks based upon their adjusted gross. The CARES Act provides eligible individuals with a refund check equal to 1200 2400 for joint filers plus 500 per qualifying child. The CARES Act allows for a five-year carryback of Federal NOLs generated in tax years beginning in 2018 2019 or 2020 and removes the 80 taxable income limitation for.

An EIP2 payment 23 de jun. The refund begins to phase out if the. The CARES Act provides eligible individuals with a refund check equal to 1200 2400 for joint filers plus 500 per qualifying child.

Here we outline 5 major tax implications that have stemmed from the new stimulus package. New York State tax implications of recent federal COVID relief. The federal Coronavirus Aid Relief and Economic Security Act CARES ACT Consolidated Appropriations Act 2021 and.

CARES Act Coronavirus Relief Fund frequently asked questions. If your 2021 income is lower than the 2019 or 2020.

The Irs Is Making A Final Push To Get Stimulus Payments To Millions Of Americans The Washington Post

Nonresident Guide To Cares Act Stimulus Checks

Stimulus Payments May Be Offset By Tax Debt The Washington Post

Everything You Need To Know About The New Coronavirus Stimulus Checks

How College Students Can Get Stimulus Money The Washington Post

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

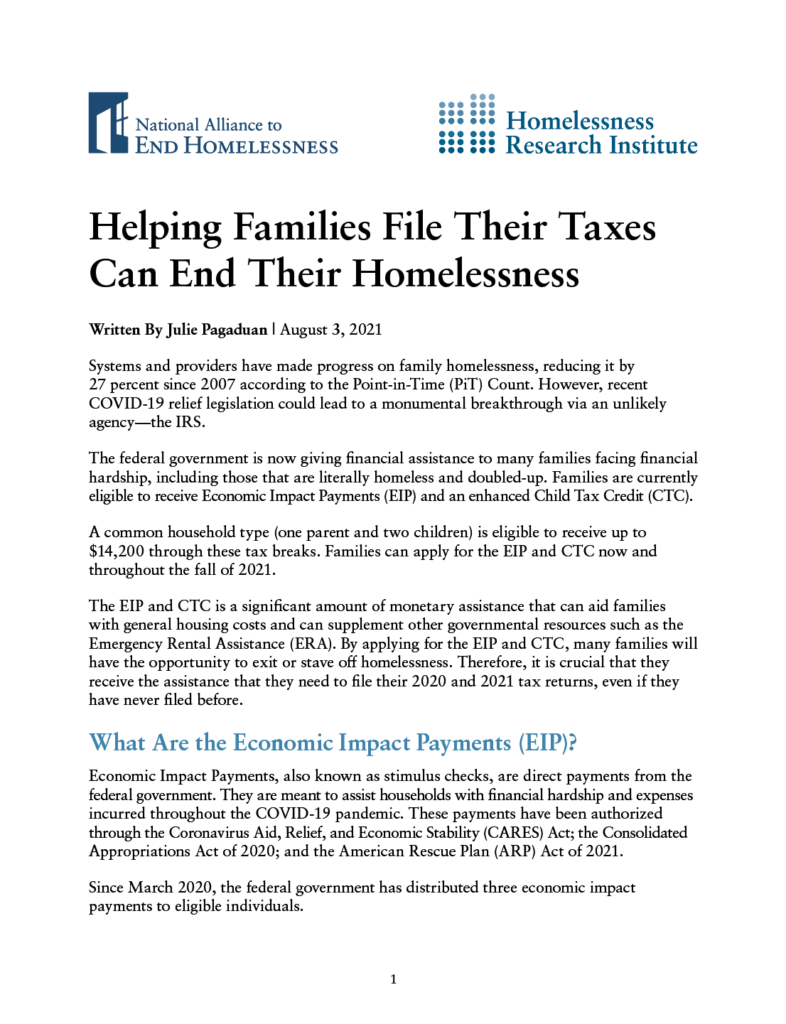

Understanding Economic Impact Payments And The Child Tax Credit National Alliance To End Homelessness

600 Stimulus Checks Are On The Way Here S Who Will Get Them First

Impact Of The Coronavirus Stimulus Checks On The Economy Julian Samora Research Institute Michigan State University

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos

Your Stimulus Check May Not Come Until 2021 The Washington Post

2 000 Stimulus Check Calculator How Much Could You Receive Through The Cash Act Forbes Advisor

Get My Payment Irs Portal For Stimulus Check Direct Deposit Money

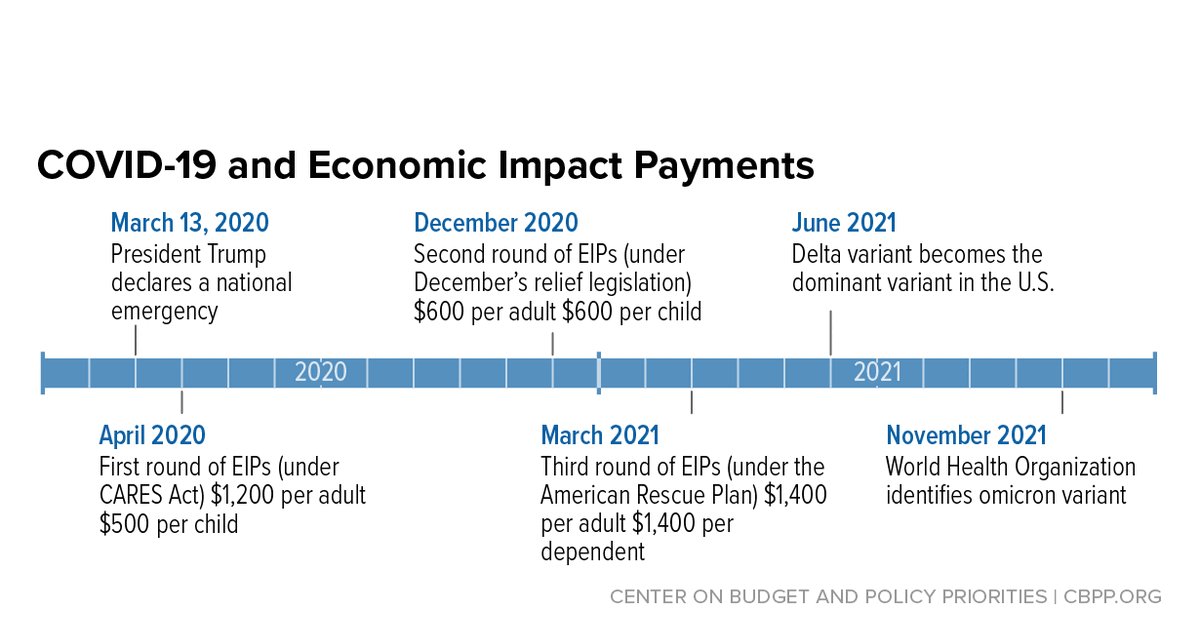

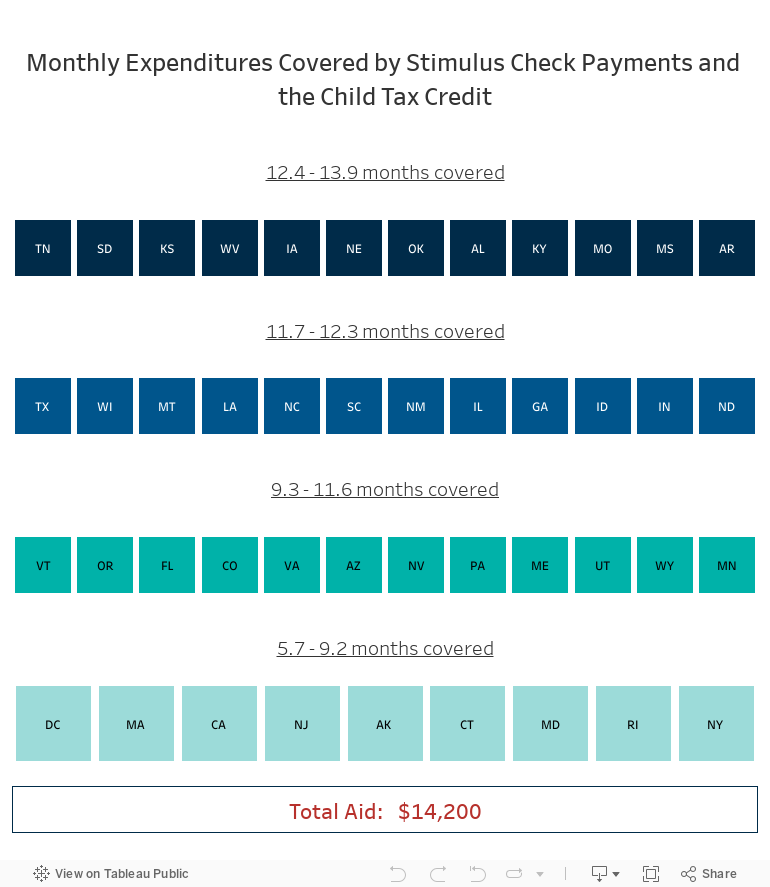

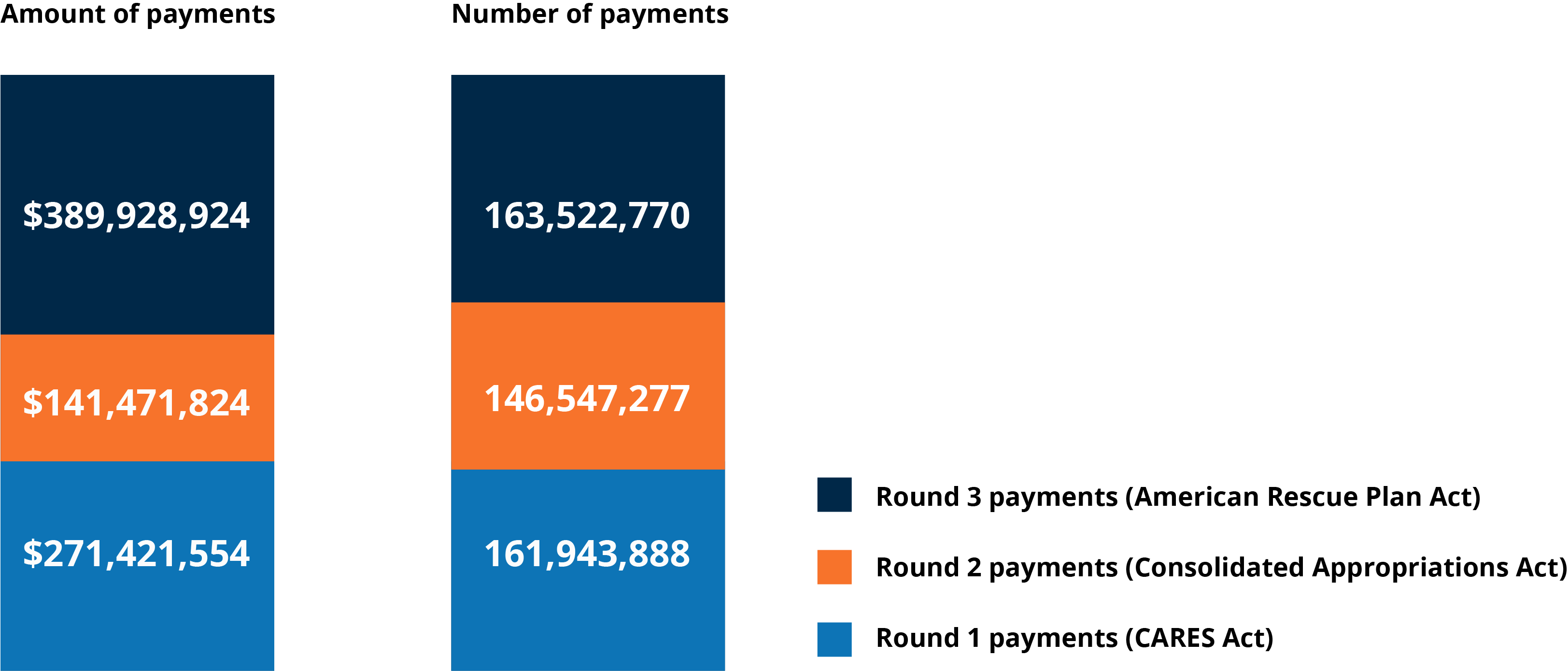

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Economic Income Payments For Immigrants Are You Eligible For A Stimulus Check Under The Cares Act Immigration And Firm News

Stimulus Checks Latest Guidance On Checks Received In Error Wegner Cpas

Understanding Economic Impact Payments And The Child Tax Credit National Alliance To End Homelessness

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

Three Rounds Of Stimulus Checks See How Many Went Out And For How Much Pandemic Oversight