missouri gas tax bill 2021

Opry Mills Breakfast Restaurants. R-Maysville speaks on the Missouri House floor on March 4 2021 file.

Applicant Tracking Spreadsheet Download Free And Free Lead Tracking Spreadsheet Template Excel Templates Business Spreadsheet Template Spreadsheet Design

Missouri Gas Tax Bill 2021.

/pumpgas-5ae60d0beb97de0039a2f57a.jpg)

. Senate Bill 262 increases the Missouri motor fuel tax rate over five 5 years by two and one-half cents per year with the first increase beginning on October 1 2021 and increases each year as. When fully implemented on July 1 2025 the gas tax would be 299. At the end of 2025 the states tax rate will sit at 295 cents per gallon.

Missouri bill would boost gas tax but offer rebates to drivers february 9 2021 by alisa nelson a proposed fuel tax increase could come with a. 53 6 Propane gas fuel five cents per. JEFFERSON CITY Mo.

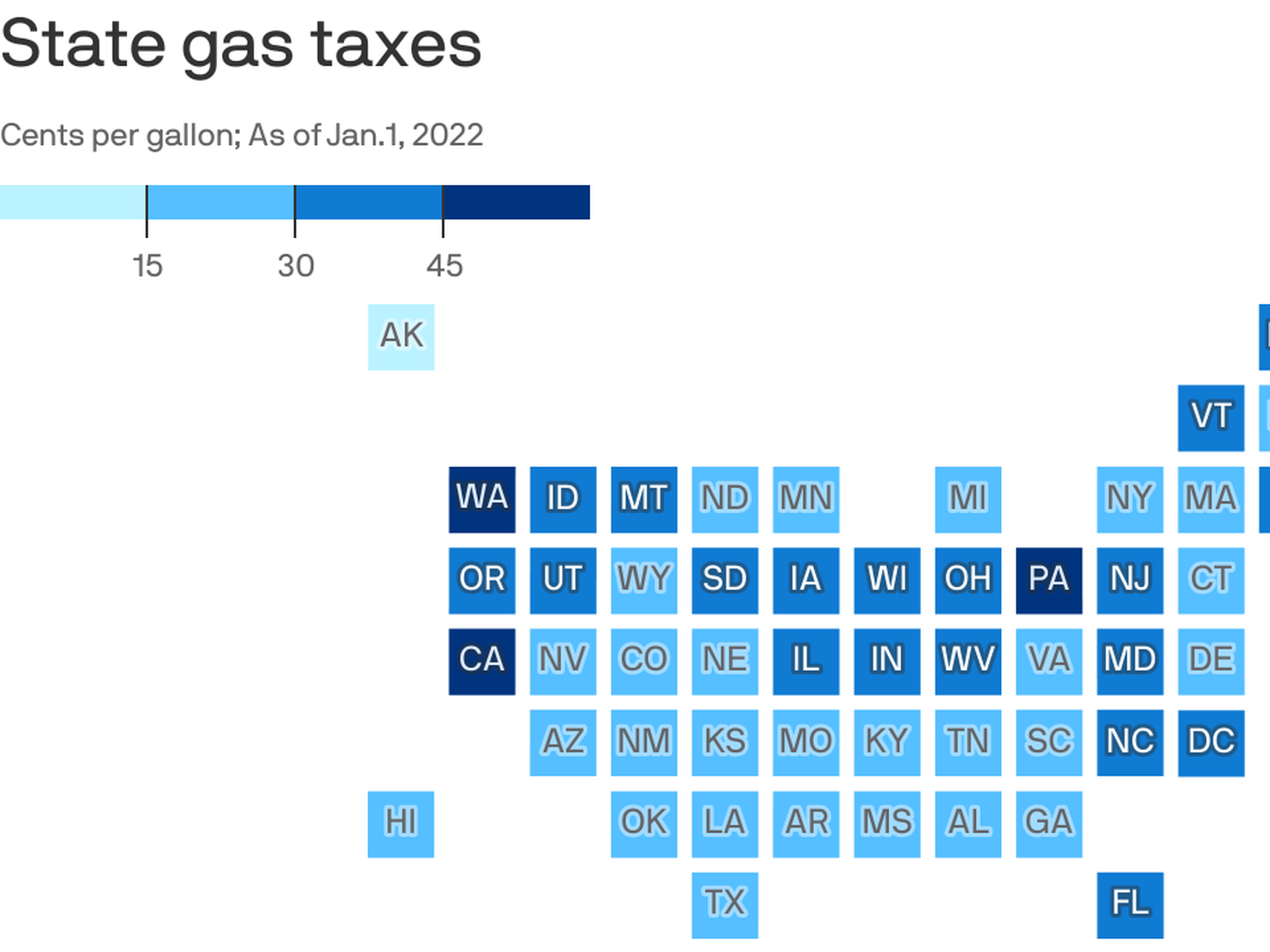

Alaska is the only state with a lower gas tax with an eight-cent-per-gallon rate. The bill would raise Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct. Patrick McKenna director of the.

The money will be used for Missouris roads and bridges. Missouris new gas tax would add 25 cents per gallon until it hits 295 cents per gallon in 2025. The measure will gradually raise the states 17-cents-per-gallon gas tax by 125 cents over the next five years.

Senate Bill 262 increases the Missouri motor fuel tax rate over five 5 years by two and one-half cents per year with the. At the end of 2025 the states tax rate will sit at. Current Bill Summary.

Missouris first motor fuel tax increase in more than 20 years takes effect on Oct. 1 until the tax hits 295 cents per gallon in July 2025. Restaurants In Erie County Lawsuit.

The first of five annual gas tax increases of 25 cents per gallon takes effect reaching a total increase of 125 cents by 2025. The increase would go into effect in October of this year. The tax if Gov.

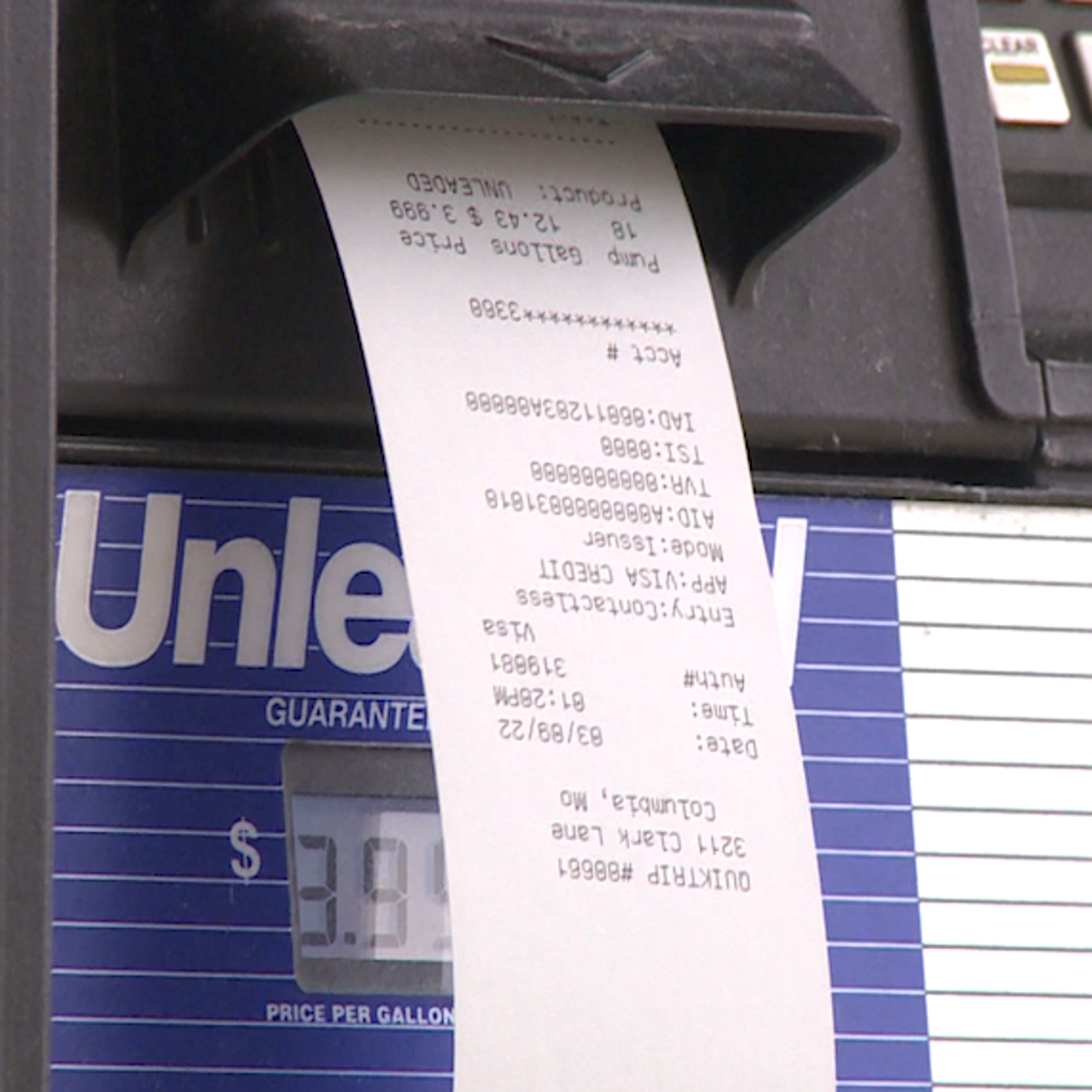

The first 25-cent increase is slated to take effect in October which will bring the gas tax to 195 cents. The legislation includes a rebate process where drivers could get a refund if they save their gas receipts and submit them to the state. New Smyrna Restaurants On Us1.

Schatzs Senate Bill 262 would increase Missouris gas tax by 125 cents per gallon by 2025. Missouris gas tax is 195 cents after the 25 cent increase in October. Missouri Gas Tax Bill 2021.

1 until the tax hits 295 cents per gallon in July 2025. Prior to October 1 2021 the motor fuel tax rate was 017 per gallon. Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning October 1 2021 through June 30 2022 for motor fuel used for.

The bill raises Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct. The tax is set to increase by the same amount yearly between 2021 and 2025. The increases were approved in Senate Bill.

The tax will go up 25 cents a year starting this October. 1 but Missourians seeking to keep that. 50 motor fuel tax shall apply to the tax imposed on liquefied 51 natural gas including but not limited to licensing 52 reporting penalties and interest.

Mike Parson signs the bill would take effect in five steps of 25 cents each starting Oct. SS2SCSSB 262 - This act modifies provisions relating to transportation. 1 day agoThe tax credit which would be applied to the 2021 tax year is equal to the amount of taxes an individual owes and in order to qualify the Missouri taxpayer must make less than.

Individuals who drive through or in Missouri could receive a refund for the increased gas taxes paid under a new plan put forth by Rep. MODOT Director Patrick McKenna said money will go towards as many of the states more than 400 unfunded projects as possible. By Cameron Gerber on September 30 2021.

The State of Missouri currently has one of the lowest gas tax rates in the country at 17 cents per gallon. Contra Costa County Sales Tax Increase 2021. Restaurants In Matthews Nc That Deliver.

In 2002 2014 and 2018 Missouri voters opposed ballot measures that would have increased. The tax increase could raise about 500. MOTOR FUEL TAX Sections 142803 142822 and 142824 This act enacts.

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

Ohio Considers Pause On Gax Tax Amid High Prices Axios Columbus

These States Have Suspended State Gas Tax Forbes Advisor

Illinois Doubled Gas Tax Grows A Little More July 1

/pumpgas-5ae60d0beb97de0039a2f57a.jpg)

Gas Taxes And What You Need To Know

A Beginners Guide To The Cash Envelope System Envelope System Cash Envelope System Cash Envelopes

Gov Mike Dewine Says Despite High Gas Prices It Would Be A Mistake To Roll Back Ohio Gas Tax Cleveland Com

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

Household Income Percentile Calculator Us 2019 Dqydj Household Income Income Household

Democrats Want To Send Cash For Gas Directly To Americans Forbes Advisor

Save Your Receipts Missourians Can Apply For Refund On State Gas Tax Increase Later This Year

Free Monthly Cash Flow Plan From Dave Ramsey Cash Flow Plan Dave Ramsey Budgeting Budgeting

/cloudfront-us-east-1.images.arcpublishing.com/gray/6F6J2G35ZRBOFCH3XCVSTLWEKQ.jpg)

Missouri Fuel Tax Increase Goes Into Effect On October 1

Missouri Fuel Tax Increase Goes Into Effect On October 1

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

Gas Tax Holiday These 17 States Are Working On Legislation To Ease Costs At The Pump Gobankingrates

Last Day Of 2021 Session Gas Tax Online Taxes Forms Of Birth Control